Disclaimer 1: Below are not legal advice

Disclaimer 2: Below are not financial advice

Business Banking is a thoroughly covered area of starting a business mostly because of a matured affiliated marketing ecosystem that exists in the financial industry(Think about all those credit card and loan comparison sites). But in the meantime, because of the various incentive behind it, you don’t always get the full picture.

Traditional Banking v.s Online Banking

Recent years sees a lot of fintech companies getting into business banking, and they are all without exception, starting with small business owners. The logic behind it is simple, smaller customers have little negotiation power and are more tolerant of occasional hiccups in their services. These new tech companies usually built a great online experience on top of some regulated banking services they can partner with, some of them eventually became a bank but by no means are as powerful and sophisticated as those big name banks, people sign up for them usually because of their easy online application process(especially nowadays most people working from their homes) and sometimes for their lower funds requirement or interest earning products.

With traditional banks, you can expect compliant and reliable services, reputable brands, and more physical presence but oftentimes rigid and slow-moving processes and frustrating online experiences, and most important, higher costs and fund requirements. Sensing fintech competitions, they often offer some sign-on bonuses which is not anything new if you have been playing the US credit card games.

I would say for a small business that does not expect a lot of cash flow and has little funds in the bank, those new online banks might be more suitable just to get started. One benefit is their virtual card that you could start using immediately after approval and also some of them provide functionalities needed for your business operation via their online products, e.g, expense tracking, tax/accounting help, and invoicing.

I chose Mercury among all other heavily marketed online business banking solutions after my research conducted via Twitter(probably the only public review site that I trust) search. Most of the startup owners are putting it as a good Brex alternative. Brex is one of the more establied names in this online business banking game and has been less friendly to small business owners recently hence I figure Mercury might be the next good thing in turns of functionality and suitability for small businesses.

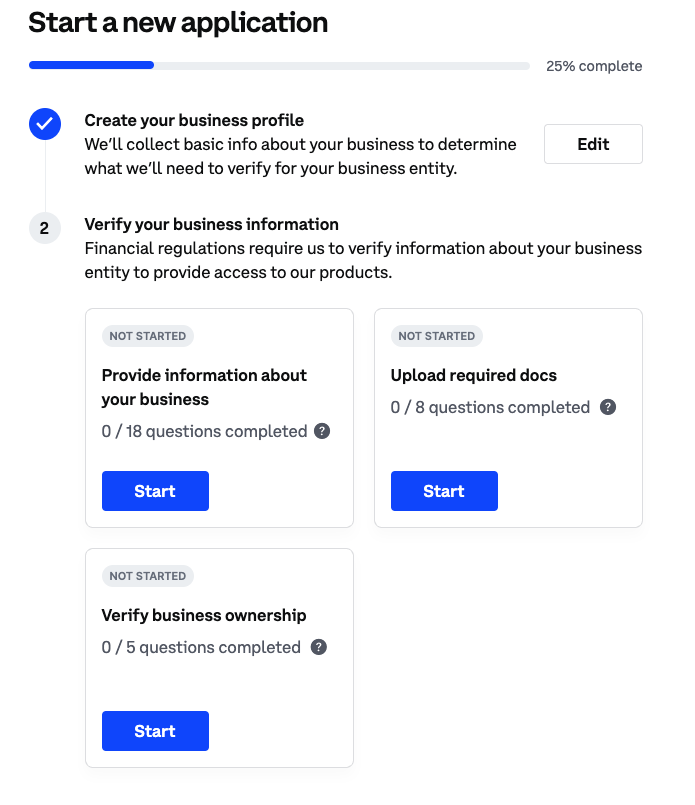

The application process is pretty simple but you do need to have your IDs and document of you business ready, and by now, you should already have them if you have finished setting up your business entity.

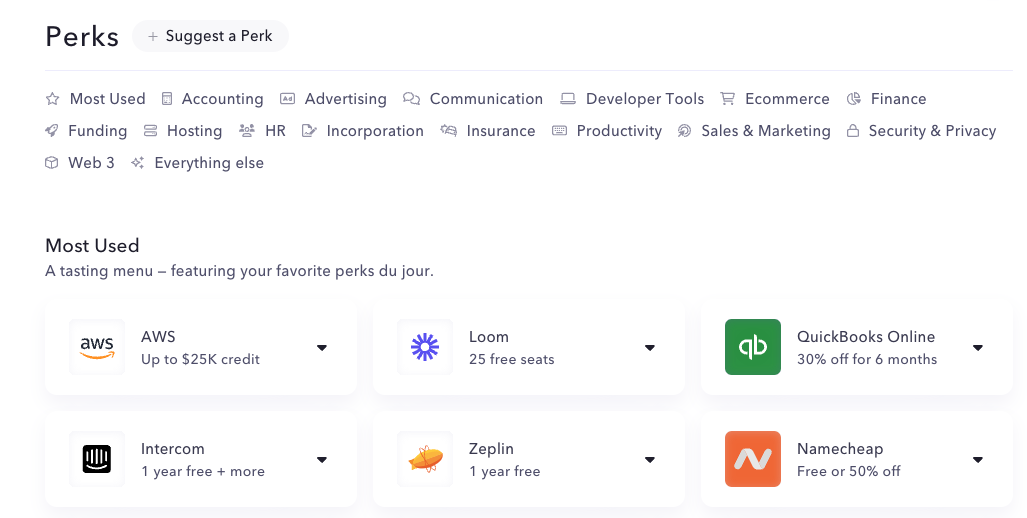

After getting approved, I do find that it offers some other unexpected perks for all the services and products you would likely need to operate a businness, highlights include the possibility to get $5k in AWS credit(which is by no means the maximum AWS credit you can get as a startup but still nice), $1k credit for Alchemy as well as 3mo free for Gusto, etc, Also you have the option to propose your product/service as a perk in their ecosystem which I think is a brilliant idea.

Notes On Crypto Banking

With crypto gaining popularity, it might be possible you are planning to accept or send payment using crypto, especially if your business is Web3 related(which if you don’t know, pretty hot recently).

Right now, I would say in the US, the most important thing regarding doing business in crytpo is compliance and getting your tax right. Hence I personally would favor more established names like Gemini and Coinbase. Both of them are operating in most US states and some international countries and offers business account and commerce solutions such as receving crypto payments and invoicing your customers.

I do need to mention that because crypto banking is relatively new, even the big names are just doing their best, so don’t be frustrated if you find their application process a bit unnecessarily complex and disorienting. Maybe it’s just their thousands of lawyers trying to piece things together, poorly…

After some back and forth with Coinbase’s customer service team, I eventually succeeded in setting up my business account with Coinbase, not the best possible experience but it is nice to know that there are real people looking at your application and figuring things out.

One good thing about Coinbase is that they recently eliminated the fees when you buy or sell USDC via fiat currency, meaning if your business is making crypto income in USDC, you can convert it to fiat currencies, e.g, USD without friction and loss.

In the process, I do want to give a shout-out to Sejda which is the best free no hassel online PDF modifying and signing tool that I can find, use it wisely so that you don’t ever need to do the print, sign and scan dance again.